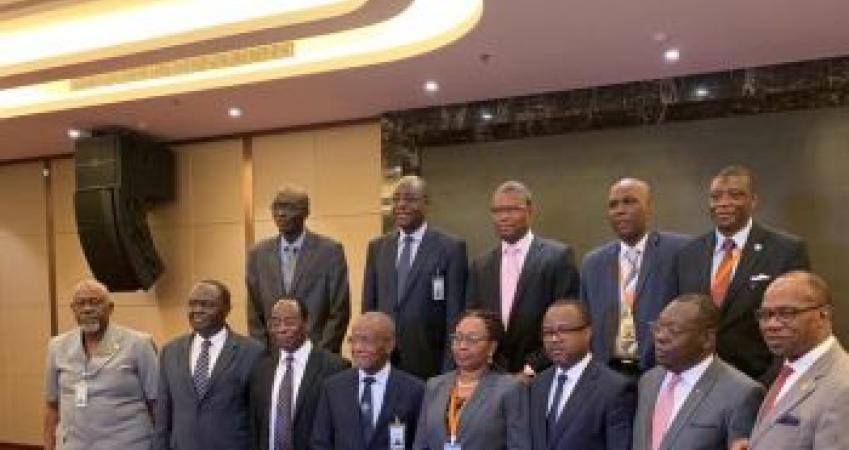

The Executive Governor of the Central Bank of Liberia (CBL) Nathaniel R. Patray, III and his Nigerian counterpart Governor Godwin I. Emefiele held a fringe meeting to discuss issues of mutual interests including Liberia-Nigeria trade during the just-ended joint statutory meetings of WAMZ (West African Monetary Zone), West African Monetary Agency (WAMA) and West African Institute for Financial & Economic Management (WAIFEM), held in Conakry, Guinea 16-23 August, 2019. As a result of the discussions, the Executive Governor of the Central Bank of Nigeria (CBN) is expected to visit Liberia shortly to continue discussions on Liberia-Nigeria trade, following which a scoping mission will from Nigeria will be fielded to Liberia to discuss the technical details of the proposed collaboration.

Governors Patray and Emefiele reasoned that it would be beneficial to both Liberia and Nigeria to have a framework that would facilitate trade between their two countries by using their domestic currencies. Unlike the current practice where for instance someone who wants to buy goods from Nigeria but have Liberian Dollars (LRD), needs to first change the LRD to United States Dollars (USD), and upon getting to Nigeria, change the USD to Naira, the proposed framework is envisaged to make Naira available through the financial system in Liberia. This will reduce transaction cost, promote cross border trade and hasten efforts towards the actualization of a common currency zone within the Economic Community of West African States (ECOWAS).

Governor Patray was accompanied at the joint WAMZ and WAMA statutory meetings by CBL Deputy Governor for Economic Policy, Dr. Musa Dukuly and other senior CBL staff members.

During the statutory meetings of the ECOWAS central banks, the technical committees and the Committee of Governors discussed progress made in implementing the ECOWAS Monetary Cooperation Programme (EMCP) and received reports on the economic performance of member states and their compliance with the macroeconomic convergence criteria. The preparedness for monetary union, the rising debt profile and exchange rate developments were also discussed at the joint statutory meetings.

The Governors of ECOWAS central banks committed themselves to real convergence, a regional payments system project and the integration of the financial and capital markets in the sub-region.